- 120 Parade Street, Kingston, Georgetown, Guyana

- +592-223-5583

The Bankability Fund is a financing mechanism developed by ActionINVEST Caribbean Inc. (ACI) in collaboration with the Cherie Blair Foundation for Women (CBFW) and the Inter-American Development Bank – IDB Lab. It aims to support women entrepreneurs in Guyana by providing equity finance to help them grow their businesses.

The Inter- American Development Bank (IDB) through the Social Entrepreneurship Program has also partnered with ActionINVEST Caribbean Inc. (ACI) in making Funds available that will be used through equity financing to further eliminate the financial bottleneck and hence improving the bankability of women entrepreneurs.

It aims to provide equity financing opportunities to Women Entrepreneurs meeting predefined criteria and operates through a co-financing strategy between ACI and CBFW.

KEY FEATURES:

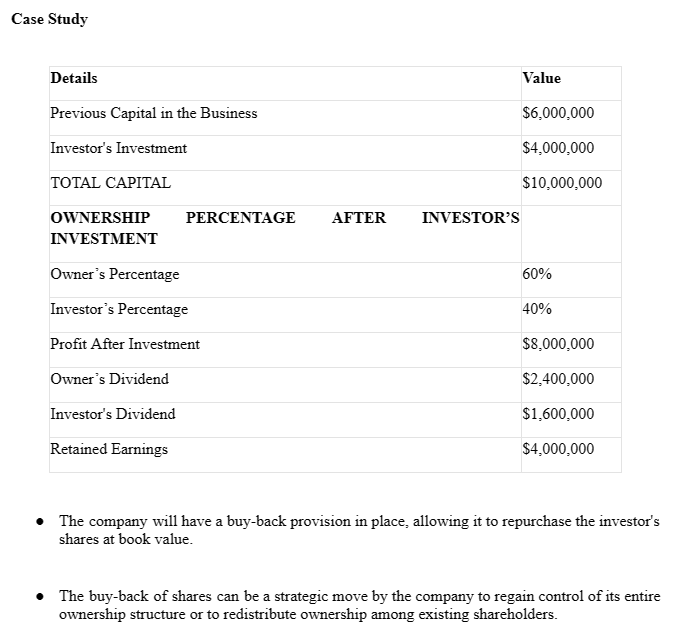

Equity finance provided to women-led businesses, repayable over 36 months, with the aim of ownership of less than 50% of the shares of the businesses.

Eligible entrepreneurs may be considered for debt financing, sale of their business, or repurchase of their shares after the repayment period.

Co-financing strategy between ACI, CBFW & IDB Lab.

Oversight by a Steering Committee to ensure effective operation and impact.

Implement a pilot program for equity investment in high-growth potential women-led businesses in Guyana to facilitate growth and access to financing from external financial institutions.

Foster economic growth and gender equality through entrepreneurship.

Provide financial support and guidance to help women entrepreneurs succeed.

The equity fund in its pilot stage will be managed by a unit, led by the Executing Agency’s founder and chairperson, who has experience in identifying and managing initial equity investments in women-led businesses funded internally and through personal capital.

The equity financing provided by the Fund is structured as an investment in the form of shares in the investee company.

The Fund aims to provide a flexible investment model tailored to the needs of each individual business, with investment amounts and terms negotiated based on the specific growth plans and financial projections of the business.

Investee companies will receive between US$10,000 to US$30,000 in equity financing for a 1-3 years period to drive targeted growth.

In addition to financial support, the Fund will provide investee companies with access to a range of support services, including business mentoring, coaching, and networking opportunities.

The Fund will also work closely with investee companies to develop and implement a tailored growth strategy, leveraging the expertise of the Fund’s dedicated unit and external partners.

The Executing Agency will establish a unit comprising a business support manager, a business analyst, and an administrative manager to manage and monitor investee businesses.

Shareholder agreements will include the appointment of a director to the investee company’s Board of Directors and a commitment to hold regular meetings with the Executing Agency to review operational and financial performance against agreed key performance indicators.

Investee companies will be subject to screening according to the Executing Agency’s Know Your Customer and Environmental and Social Guidelines.

Investee companies will sign a shareholder agreement agreeing to a buyback of shares issued to the Executing Agency within the agreed investment period and appoint a director representing the Executing Agency to its board who can act as a signatory on the bank account for investment related purposes.

Entrepreneurs apply for funding through a structured application process.

Selected businesses receive equity finance ranging from USD $10,000 to $30,000 based on their growth potential, financial viability and willingness to incorporate.

Recipients are supported with financial guidance, training, and mentorship to help them grow their businesses.

Empowering women entrepreneurs to achieve their business goals & business growth.

Fostering a supportive ecosystem for women-led businesses.

If you’re a woman entrepreneur in Guyana, learn more about the eligibility criteria and application process.

If you’re interested in supporting the Bankability Fund as a partner or donor, contact us on +592-223-5583 for more information.

ActionINVEST CARIBBEAN INC. (ACI) is focused on becoming the Caribbean’s Solution to Professional & Organizational Growth through our Action Oriented Team delivering targeted services to individuals and organizations seeking to Invest in their own growth.